Our approach in dealing with client’s credit issue is what makes us stand out in the market. Aided with a qualified and certified team and with instrumental part of advance level technology, we provide personalized legal solution for every query of client in accordance with CIC guidelines. At a same time Funding kart is working towards creating credit awareness through seminars for general public as well as bank officials which unfolds the positive outcome on society in terms of Individuals having eligibility for quick loan approval, SMEs to have financial extensions and Bank have to curb their worry towards NPA issue.

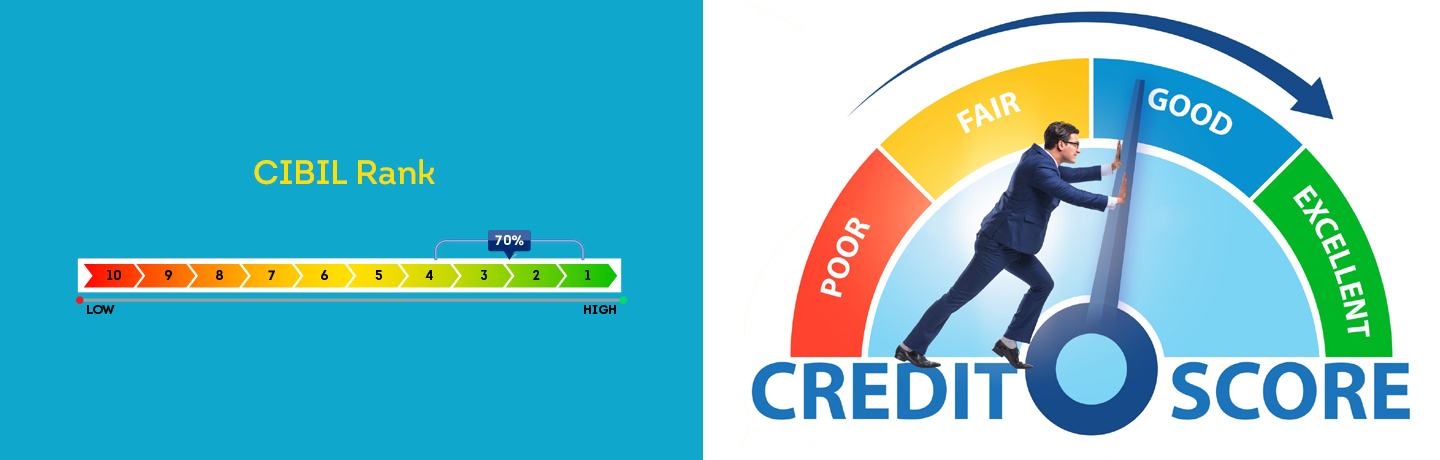

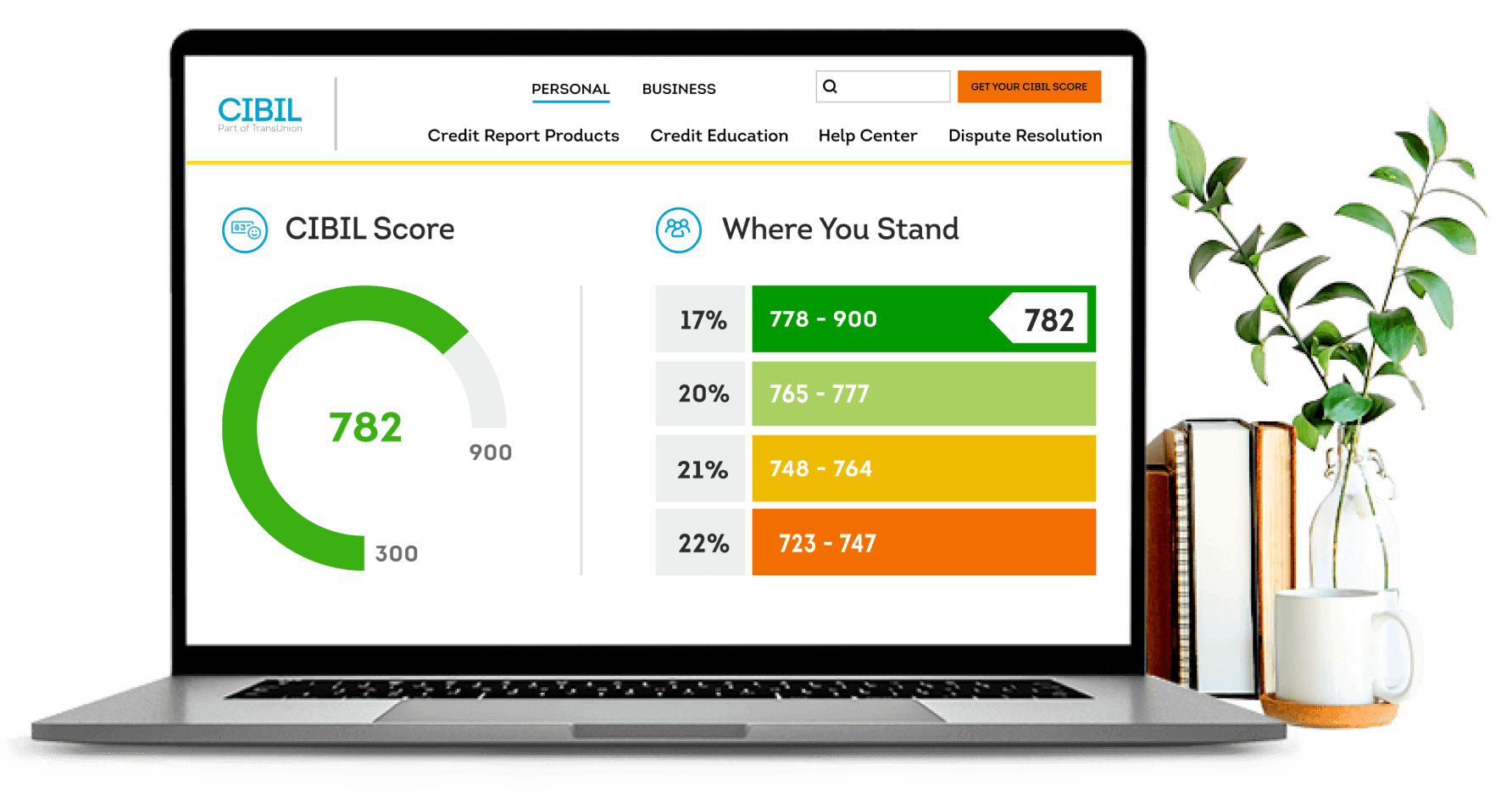

Just like Permanent Account Number (PAN) forms your identity while carrying out any financial transactions, a credit score acts as your identity in the world of credit. Your PAN is required undoubtedly, but your credit score assumes more importance here. For the uninitiated, a Credit Score is a numerical representation of your creditworthiness. This score is arrived at by giving weight to your past credit behavior. Credit scores are in the range of 300-900, with higher scores indicating higher grades of creditworthiness. The only way you can be eligible for any credit on favorable terms these days is with a good credit score.

You might have read and heard a lot on the need to have a good credit score. Let us go a step further and explore what is in store for you if you are armed with a good credit score.

Why is my credit score low?

Higher Credit Utilization ratio: Credit Utilization ratio is one of the main components of a credit score. Your earlier score would have been calculated as per your existing credit utilization ratio. However, if there has been a consistent increase in your credit utilization ratio your credit score would have dropped down. Higher utilization is an indicator of poor credit habits.

Missed a repayment: Credit scores are all about how efficiently you manage your existing credit. Repayments of loans are the cornerstones of good credit behavior and missing a couple of them will have a negative bearing on your credit score. It is quite common that we end up missing a due date. In such cases, it is good to inform your lender immediately that you have missed the due date and immediately pay up the missed EMI with penalties if any. This would do some damage control than totally missing the repayment.

Closed your existing credit relationships: The duration of the credit relationship with a lender also is one of the factors deciding your credit score. It gives a better view of how a person has been managing credit over an extended period of time. If you suddenly close one of the old credit card accounts because you got a better offer, the fact may not bode well for your credit score.

Availed new loans: Availing new loans or frequent loans over a small period of time will show an individual as a credit hungry person. Consequently, there is bound to be a drop-in credit score.

6 Reasons Why Your Credit Score is not Improving!

Errors in the credit score: There are some factors that affect your credit score which is beyond your control, like errors in the credit score. These errors may be due to wrong reporting from your lender’s end. All lenders report information related to repayment, opening, and closure of credit account to the credit bureaus. A small error like using the term “Settled” instead of ” Closed” brings a drop in your credit score. Missing a repayment can also have a similar effect.

There might also have been cases where your PAN was used for some other loan applications resulting in hard inquiries. This is what happened to the individual we talked about earlier. The PAN mismatches might have been intentional or due to oversight.

Benefits of Good Credit Score :

Lower Rates of Interest: The rate of interest on loans is a deal breaker. Everyone looks for the lowest possible rate of interest on loans/credit cards. From the lenders’ point of view, interest is their reward for giving you the loan and taking a risk on it. A good credit score implies that a person has been responsible with credit previously and will possibly do so in future. Therefore, lenders would like to lend to those individuals with good credit score and at a lower rate of interest than the ones offered to individuals with bad credit score. In fact, many banks and NBFC’s have already put this in practice. For Example: For SBI Car Loan Lite, the bank charges an interest rate of 11.4% p.a for credit score greater than 750 and 12.4% for scores in the range of 649-750. Paying 1% extra during the entire term of the loan will be a significant outgo from your pocket.

Better Chances of Loan and Credit Card Approval: The real benefit of credit can be realized if it is approved when it is needed the most. While some loans like the home loans and auto loans are secured by the underlying asset, certain others like personal loans and credit cards are unsecured credit. Therefore, the lender would like to be doubly sure of repayment on time before approving the credit. An individual with a good credit score, therefore has better chances of getting a quicker approval on loans and credit cards.